Are you looking for a credit card that rewards you for your everyday purchases? The Buckle Credit Card is designed to provide consumers with exceptional benefits while shopping at Buckle stores or online. This article will delve into the features, benefits, and tips associated with the Buckle Credit Card, ensuring that you make the most out of your financial decisions. In today’s fast-paced world, choosing the right credit card can significantly impact your financial health and lifestyle. With numerous options available, it’s essential to understand the advantages and potential drawbacks of each card. This comprehensive guide aims to equip you with all the necessary information regarding the Buckle Credit Card, making it easier for you to decide if it’s the right fit for your needs.

The Buckle Credit Card not only offers rewards on purchases but also comes with various perks that can enhance your shopping experience. This card is particularly appealing to those who regularly shop at Buckle, as it provides exclusive offers and discounts. In this article, we will also explore the application process, payment options, and tips on managing your credit card effectively. By the end, you will have a clearer understanding of how to leverage this credit card for your benefit.

With the increasing importance of credit scores and financial literacy, it is crucial to make informed choices about credit cards. The Buckle Credit Card is an excellent option for consumers who appreciate fashion and want to maximize their rewards. Let’s dive into the details and discover everything this card has to offer.

Table of Contents

- What is the Buckle Credit Card?

- Benefits of the Buckle Credit Card

- How to Apply for the Buckle Credit Card

- Payment Options

- Managing Your Buckle Credit Card

- Buckle Credit Card vs. Other Cards

- Frequently Asked Questions

- Conclusion

What is the Buckle Credit Card?

The Buckle Credit Card is a store credit card offered by Buckle, a popular retailer specializing in casual apparel and accessories. This card allows consumers to earn rewards for their purchases, especially when shopping at Buckle. It is an ideal choice for fashion enthusiasts who frequently visit the store or shop online.

Personal Information and Biodata

| Attribute | Details |

|---|---|

| Issuer | Comenity Bank |

| Rewards Program | Earn points on purchases |

| Annual Fee | $0 |

| APR | Variable APR based on creditworthiness |

| Credit Score Requirement | Good to excellent credit |

Benefits of the Buckle Credit Card

The Buckle Credit Card offers a variety of benefits that can enhance your shopping experience. Here are some of the key advantages:

- Reward Points: Earn points for every dollar spent, which can be redeemed for discounts on future purchases.

- Exclusive Offers: Access to special promotions and discounts available only to cardholders.

- Birthday Bonus: Receive a special birthday gift in the form of reward points.

- No Annual Fee: Enjoy the benefits of the card without incurring an annual fee.

How to Apply for the Buckle Credit Card

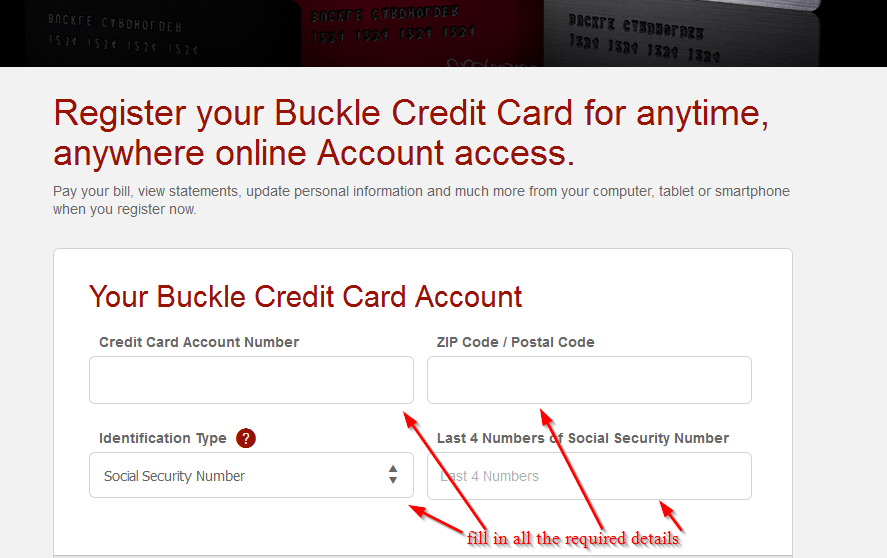

Applying for the Buckle Credit Card is a straightforward process. Here’s how you can complete your application:

- Visit the official Buckle website or go to a Buckle store.

- Fill out the application form with your personal and financial information.

- Submit the application and await approval. You may receive an immediate decision.

Payment Options

The Buckle Credit Card offers flexibility when it comes to making payments. Here are some of the available payment options:

- Online Payments: Log in to your account on the Buckle website to make payments easily.

- Mobile App: Use the Buckle mobile app to manage your account and make payments on the go.

- Mail Payments: Send your payment via check to the address provided on your billing statement.

Managing Your Buckle Credit Card

Effective management of your Buckle Credit Card is essential for maintaining a good credit score and maximizing its benefits. Here are some tips to help you manage your card:

- Pay on Time: Always make your payments on time to avoid late fees and interest charges.

- Monitor Your Transactions: Regularly check your account for any unauthorized transactions.

- Utilize Rewards: Keep track of your reward points and redeem them before they expire.

Buckle Credit Card vs. Other Cards

When considering the Buckle Credit Card, it's important to compare it with other credit cards to determine if it meets your needs. Here’s how it stacks up:

- Buckle Credit Card: Best for frequent Buckle shoppers who want to earn rewards on their purchases.

- General Rewards Credit Cards: Ideal for those who prefer flexibility in redeeming rewards across various retailers.

- Cashback Cards: Suitable for consumers who want straightforward cashback on all purchases rather than points.

Frequently Asked Questions

Here are some common questions about the Buckle Credit Card:

- Is there an annual fee for the Buckle Credit Card? No, the Buckle Credit Card does not have an annual fee.

- Can I use the Buckle Credit Card outside of Buckle stores? Yes, you can use it for online purchases at Buckle and at select locations.

- How do I check my reward points? You can check your reward points by logging into your account on the Buckle website or app.

Conclusion

The Buckle Credit Card is an excellent option for avid shoppers at Buckle, offering various rewards and benefits. By understanding how to apply, manage, and maximize your rewards, you can make the most out of this credit card. If you’re interested in enhancing your shopping experience, consider applying for the Buckle Credit Card today!

We encourage you to leave a comment below if you have any questions or share your experience with the Buckle Credit Card. Don’t forget to check out our other articles for more financial tips and insights!

Thank you for reading, and we look forward to seeing you back on our site for more valuable content!